For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

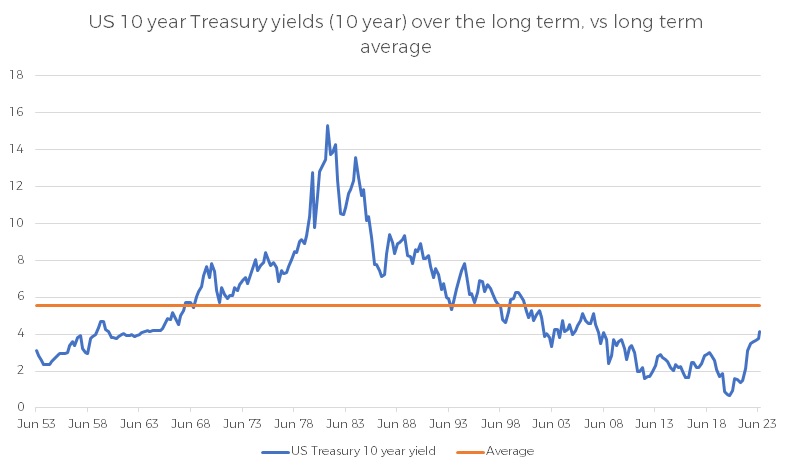

Much has been made in recent weeks of US Treasury yields reaching multi year highs and, as the graph below shows, it has been a fairly stark move higher over the last couple of years. Indeed, yields are now the highest since the beginning of the Global Financial Crisis in September 2007.

It’s illustrative of how long yields have been at very low levels as, even though they are currently the highest for 16 years, they have still not reached the long term average, i.e. since 1955, depicted by the black line below.

Source: Bloomberg 30/08/2023 – 30/06/1953

Are materially higher yields a negative or positive development? Of course bond yields might not stay at these levels but already they are very different to the last few years and that does have implications, both positive and negative. On a positive note, it can be argued that a normalisation of yield levels is a healthy sign, so long as it’s not in an uncontrolled manner, with capital encouraged to be allocated more efficiently as investors, companies and governments have to think more clearly about their prospective return, in a world of higher cost of capital.

There are broader risks too, some related to the positives just mentioned. For example, refinancing risk, where corporates and governments will find it more expensive to roll over their debt. More generally, higher rates from central banks are of course designed to slow the economy in order to reduce inflation, the hope from central banks is that it is achieved in an orderly manner, rather than leading to things breaking, as we saw recently with the regional banking crisis in the US.

From a US Treasury perspective, there is now better value in this important asset class and this means that it will be harder for investors to lose money in US Treasuries compared to the last few decades, certainly in nominal terms. For other asset classes there are implications too. For corporate bonds, their yields will be at more attractive levels too, spreads remaining equal. For equities, at least relative to bonds, investors will be looking to demand higher returns, as they eye bonds as a more competitive asset class in terms of their yields. This will be particularly the case for lower yielding growth stocks.

The Federal Reserve remain data dependent which sounds nice and clean but is of course muddied by the lagged effect of rate moves. Inflation and the labour market will be key data areas and though the labour market looks less hot, inflation is getting some upside pressure from higher energy prices and easier year on year comparisons. All in all, we retain our base case that rates will be higher for longer and, in the short term, the higher chance of a reacceleration in inflation supports this.

Anthony Rayner

Premier Miton Macro Thematic Multi Asset Team