Will Labor Day in the US mark both a change in the seasons and a change in market leadership?

US equity fund manager, Hugh Grieves, reflects on whether a day celebrating the American labour and trade unions movements could be a key inflection point for markets.

For information purposes only. The views and opinions expressed here are those of the author at the time of writing and can change; they may not represent the views of Premier Miton and should not be taken as statements of fact, nor should they be relied upon for making investment decisions.

The beginning of the next season?

Labor Day has been a US Federal bank holiday since 1894, always on the first Monday in September. Officially it celebrates the American labour and trade unions movements, like the 1st May holiday in Europe, with parades and parties. Unofficially for most Americans though, it is a turning point in the year, the end of the summer holidays and the beginning of the next season.

Monetary policy aftersun for a blisteringly hot labour market

It is also possible that this year it marks a change in the US labour market’s conditions. Since the pandemic, the market for workers has been blisteringly hot. As the economy rebounded, employers struggled to find enough new workers to meet surging demand, resulting in lengthening lists of vacancies, frequent job hopping and rapidly rising wages.

Even as inflation has cooled from the extremely high levels seen in early 2022, the Federal Reserve has fretted that higher wage costs being passed on to customers would result in consumer price inflation being ‘sticky’ and slow to fall back to the Fed’s target of two percent per year.

With this in mind Jerome Powell, the Chairman of the Federal Reserve, has talked up the need to keep raising interest rates to cool the labour market even at the risk of pushing the US economy over a cliff and into a recession. Such talk has unnerved equity markets, encouraging investors to retreat to the relative safety of a handful of mega-cap technology stocks to the detriment of the rest of the equity market. New economic data released just before this holiday weekend however, appears to suggest that the risk of this ‘hard landing’ scenario is receding as the labour market is now cooling.

Back to balanced?

Firstly, the demand for workers is waning. The JOLTS US job openings figure aggregates all the employment vacancies in the country. In 2019, there was around seven million openings advertised each month. At the peak in April last year, there was twelve million job openings as companies scrambled to add capacity and hire to cover unwanted attrition. The latest figure for July, show a decline to 8.8 million open positions, still ahead of the levels seen before the Covid pandemic but much more normal than last year.

Secondly, the supply of available workers is improving. Earlier as a consequence of the pandemic, many workers withdrew from the workforce due to retirement, ill health or personal reasons. Many more potential employees never even joined the workforce as borders were closed through lockdown preventing any immigration (legal or illegal). This left fewer workers at the end of the pandemic than there were before. But within the data released in the US Labor Department’s monthly nonfarm payrolls report for August, even as the economy added a healthy 187,000 new jobs in August, 736,000 workers re-joined the job market, pushing the unemployment rate up from 3.5% to 3.8% and increasing the availability of employees.

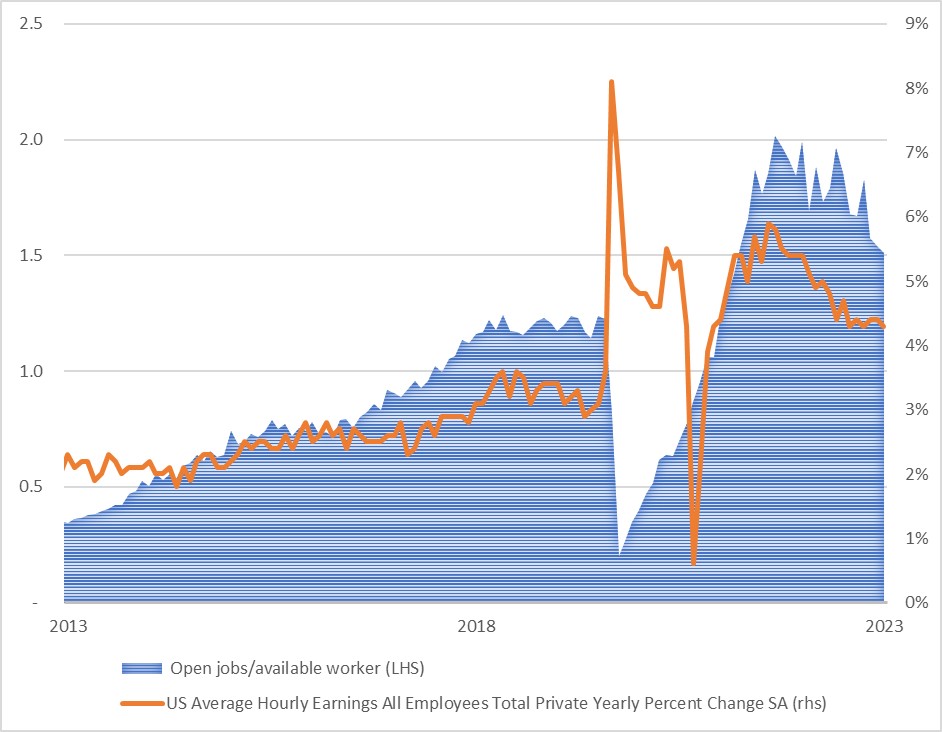

So finally, the labour market is coming back towards balance as demand falls and supply improves. Having peaked at two job openings for every available potential worker, the ratio has today fallen to about 1.5 (please see chart below) with room to fall further. And encouragingly for the Federal Reserve, post-inflation wage growth, which had peaked at almost 6%, falling to nearer 4% more recently, will likely fall even further as employers compete less for workers, taking pressure off companies to raise prices. As a result, markets have already sharply reduced the odds of further interest rate increases this year.

Less competition for wages is taking the pressure off wage inflation

Source: Bureau of Labor Statistics and OECD data from 01.01.2013 to 31.08.2023.

A change in market leadership?

With the Fed potentially becoming more relaxed about the need to cool the labour market through further interest rate rises, investors have started to become less fearful of the Fed triggering a recession. As confidence in the economic outlook builds further, this may broaden out in the market to those company shares which have been neglected so far this year, mainly due to macro concerns, resulting in them starting to catch more investor attention.

As Labor Day marks the change in the seasons, it may also mark a change in market leadership.